September Industry Updates

September 2025 proved to be a successful month for the UK’s electric vehicle market, led by a substantial increase in battery-electric vehicle (BEV) registrations. New SMMT data revealed a strong surge this September for BEVs, supported by parallel growth across plug-in hybrid (PHEV) and hybrid (HEV) segments. While passenger car volumes provide important context, the standout story lies within the light commercial vehicle (LCV) sector, where electric vans recorded their highest set of monthly registrations this year, signalling a significant shift in the fleet and business market. This momentum has been fuelled by greater model availability, extended government support schemes, and improved charging infrastructure. These developments mirror broader global trends, including record clean energy generation and rising consumer confidence, this is evident particularly among younger drivers which appears to be accelerating the UK’s transition to electric mobility.

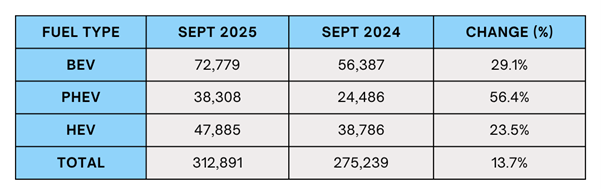

SMMT September 2025 Registrations

The latest SMMT figures highlight a clear upward trajectory across all electrified powertrains. Battery-electric vehicle (BEV) registrations increased by 29.1% year-on-year, reflecting their growing mainstream appeal. Plug-in hybrid (PHEV) volumes surged by 56.4%, underlining their role as a popular transitional technology for many consumers. Hybrid-electric vehicles (HEV) also recorded solid growth, up 23.5% compared to September 2024. Meanwhile, total registrations across electrified powertrains increased by 13.7% compared to September 2024, underlining the continued expansion of the EV sector.

Source: https://www.smmt.co.uk/vehicle-data/electric-vehicle-registrations/

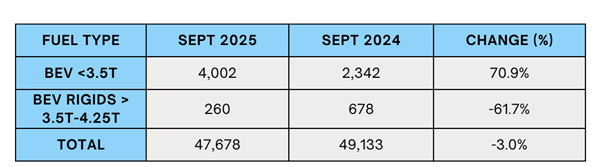

Electric Vans

The electric van market saw mixed results in September. Registrations of sub-3.5 tonne BEV vans rose sharply by 70.9% compared to September 2024, reaching 4,002 units, marking a significant milestone for the segment. In contrast, BEV rigids over 3.5–4.25 tonnes recorded a 61.7% decline, falling to 260 units compared to the same month last year. Overall LCV registrations (all fuel types) decreased by 3.0%, totalling 47,678 units for the month. This performance reflects both strong momentum in the core sub-3.5t market and ongoing challenges in the heavier segments. Supportive government schemes, including the Plug-in Van Grant (PIVG) and Depot Charging Scheme (DCS), continue to encourage uptake, particularly among operators transitioning to smaller electric vans.

Source: https://www.smmt.co.uk/vehicle-data/lcv-registrations/

Industry Commentary: The shift accelerates

Industry voices suggest that September’s figures are reflective of a deeper global energy shift. On LinkedIn, Chris Chandler, Principal Consultant at Lex Autolease, pointed to recent data showing global renewable generation surpassing coal as evidence the clean-energy transition is accelerating. He noted that China and India are leading this change, while the UK is contributing significantly through its robust offshore wind infrastructure. Meanwhile, Chinese EV makers are expanding rapidly in Europe and the UK, altering the competitive landscape for automakers. Chandler argues that the moment experts have long anticipated has now arrived – the direction of technology is set, and businesses must evolve if they hope to maintain relevance in the decade ahead.

Source: https://www.linkedin.com/in/chris-chandler-756b9813/

Used EV Market: Record Demand

The strength of the EV market was also reflected in used car activity. Indicata’s Market Watch data shows that used EV demand hit record levels in September, with market days’ supply (MDS) dropping to just 44 days, which is the lowest on record: signalling quicker turnover of stock. Used EVs achieved also an 8.2% market share, up from 7.6% in July, highlighting growing consumer confidence in second-hand electric models. This healthy used market is crucial for sustaining new EV sales, supporting stronger residual values and giving fleets greater confidence in their investments.

Source: https://indicata.co.uk/market-watch/

Consumer Behaviour: Young Drivers Leading the Shift

Consumer attitudes are also shifting rapidly, particularly among younger demographics. Research by Venson Automotive Solutions found that 87% of drivers aged 25–34 plan to switch to an EV sooner than before due to the Electric Car Grant. Across all age groups, 51% of respondents said the grant would encourage them to make the switch earlier. However, there are generational differences, with only 22% of 55–64-year-olds saying the grant would influence their decision. Gender differences also remain, with 49% of men considering an EV compared to 38% of women. These figures underline the importance of targeted engagement strategies to sustain momentum across all consumer segments.

Source: https://www.venson.com/

Conclusion: A Defining Month for the EV Market and how this affects us at Morris Commercial

September 2025 represents a pivotal moment for the UK EV sector. With strong growth across all vehicle types, record-breaking van adoption, and a flourishing used market, the foundations for sustained electrification are strengthening. Consumer sentiment is moving in the right direction, younger drivers are leading the charge, and global energy trends are increasingly supportive. The challenge now is to maintain this momentum to meet ambitious policy targets and accelerate the transition to zero-emission mobility.

For us at Morris Commercial, these trends highlight significant opportunities. The record growth in sub-3.5t electric vans and the rising market share of EVs demonstrate increasing fleet demand, positioning the Morris JE as a timely and relevant solution for businesses seeking low-emission alternatives. Beyond the fleet sector, the surge in EV registrations across both passenger cars and vans, combined with stronger consumer confidence, particularly among younger drivers, reflects a market that is rapidly maturing. Government initiatives such as the Plug-in Van Grant (PIVG) and Depot Charging Scheme (DCS) continue to play a key role in supporting adoption, while robust demand in the used EV market is helping to build long-term confidence in electric vehicles. As competition grows, Morris Commercial is well placed to build on this momentum and support the UK’s transition to zero-emission mobility